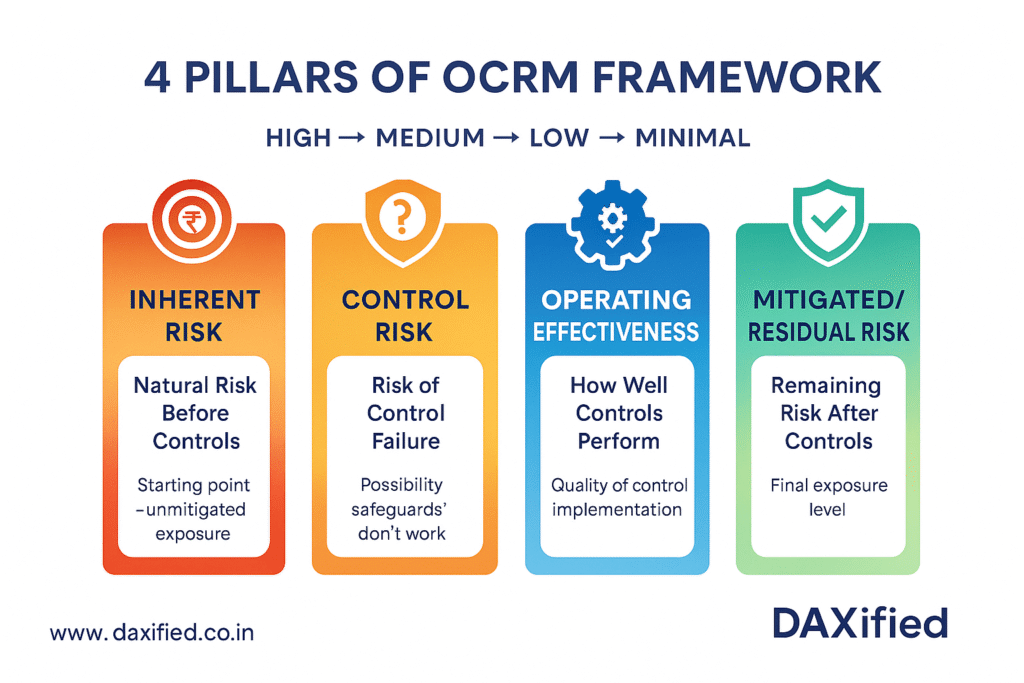

💡 OCRM Framework Overview: Understanding the relationship between Inherent Risk (natural business exposure), Control Risk (protective measure failures), Operating Effectiveness (control performance), and Mitigated Risk (remaining exposure) is crucial for effective risk management. This comprehensive framework visualization demonstrates how systematic risk reduction transforms high-impact Inherent Risk into manageable Residual Risk:

“Understanding OCRM requires a visual approach. The framework below demonstrates how systematic risk management transforms high-exposure scenarios into controlled, manageable outcomes through proven methodologies.”

OCRM Explained

Understanding Risk Management Through Real Currency Hedge Examples

Explore More on DAXifiedDemystifying the Overall Control Risk Model

Learn how the Overall Control Risk Model (OCRM) helps organizations measure and manage risks using practical currency hedging examples that everyone can understand.

🎯 What is OCRM and Why Should You Care?

Imagine you’re planning a trip abroad and need to exchange money. The exchange rate keeps fluctuating, and you’re worried about losing money. How do you protect yourself? This is exactly what businesses face with much larger amounts, and the Overall Control Risk Model (OCRM) helps them navigate these challenges.

OCRM in Simple Terms: It’s a framework that helps measure different types of risks in a systematic way – from the natural risk in any situation to the risk that remains even after implementing protective measures.

The DAXified approach to explaining OCRM focuses on four key elements that work together like layers of protection:

- Inherent Risk – The natural risk before any protection

- Control Risk – The chance your safety measures fail

- Operating Effectiveness – How well those measures work in practice

- Mitigated/Residual Risk – The remaining exposure after all measures

🔍 The Four Pillars of OCRM

Let’s break down each element using a real-world currency hedging scenario that businesses face every day.

Inherent Risk

Definition: The starting risk before any protection measures.

Currency Example:

Your company expects to receive $100,000 from a US client in 3 months. Today’s rate: ₹85 per dollar.

If the dollar falls to ₹80, you lose ₹5 per dollar = ₹500,000 potential loss

This ₹500,000 is your inherent risk.

Control Risk

Definition: The risk that your protective safeguards fail to work.

Currency Example:

You buy a forward contract to sell $100,000 at ₹85 (hedge protection).

But what if:

- Bank documentation has errors

- Contract terms are miscalculated

- Settlement process fails

This possibility is your control risk.

Operating Effectiveness

Definition: How well the safeguard actually performs when tested.

Currency Example:

You implement monitoring processes:

- Regular verification of contract terms

- Monthly bank confirmations

- Treasury team oversight

Result: High operating effectiveness = very low chance of hedge failing.

Mitigated (Residual) Risk

Definition: The risk that remains after all controls work properly.

Currency Example:

Your forward contract covers only $90,000 due to bank limits.

The remaining $10,000 is unhedged.

If dollar drops ₹5: $10,000 × ₹5 = ₹50,000 residual risk

This is your mitigated/residual risk.

Internal Audit Perspective on OCRM

From an Internal Audit standpoint, OCRM provides a structured approach to evaluate risk management effectiveness. Internal Audit teams can use this framework to assess whether management has properly identified inherent risks, implemented appropriate controls, and accurately measured residual exposures. This systematic evaluation helps ensure that risk management practices align with organizational risk appetite and regulatory requirements.

🔗 How OCRM Ties It All Together

The beauty of OCRM lies in its systematic approach to risk measurement. Here’s how our currency hedge example maps to the complete framework:

| OCRM Stage | Currency Hedge Example | Risk Assessment | Financial Impact |

|---|---|---|---|

| Inherent Risk | $100,000 exposure with no hedge protection | High – Full market exposure | ₹5,00,000 |

| Control Risk | Forward contract in place, but may fail | Medium – Depends on control design | Variable |

| Operating Effectiveness | Regular verification and monitoring | Satisfactory – Well-designed processes | Very Low |

| Mitigated Risk | $10,000 unhedged due to contract limits | Low – Minimal remaining exposure | ₹50,000 |

Key Insight: OCRM reduces risk from ₹500,000 to ₹50,000 – a 90% risk reduction through systematic risk management!

💡 Why Currency Hedging Makes OCRM Clear

This analogy works exceptionally well for explaining OCRM because:

🌍 Universal Understanding

Everyone understands money and exchange rates. It makes abstract risk concepts tangible and relatable, whether you’re in finance, operations, or management.

📊 Quantifiable Impact

Numbers tell a clear story. You can see exactly how much risk exists “before and after” implementing controls, making the value of risk management visible.

🎯 Clear Stages

Each OCRM stage has a distinct, logical step in the hedging process, making it easy to understand how different types of risk interact with each other.

🔄 Real Business Application

This isn’t just theoretical – companies actually use currency hedging, making the example practical and applicable to real business scenarios.

🚀 Taking OCRM Further: Advanced Applications

Once you understand the basics through our currency example, you can apply OCRM to virtually any risk scenario:

Cybersecurity Risk Management

Inherent Risk: Potential data breach affecting 100,000 customer records

Control Risk: Firewall and encryption might fail

Operating Effectiveness: Regular security testing and monitoring

Mitigated Risk: Residual exposure to targeted attacks

Supply Chain Risk Management

Inherent Risk: Production shutdown if key supplier fails

Control Risk: Backup suppliers might not deliver on time

Operating Effectiveness: Regular supplier audits and relationship management

Mitigated Risk: Short-term disruption despite backup plans

Join Our Learning Community

Ready to dive deeper into risk management, data analytics, and business intelligence? Connect with fellow learners and industry experts!

Join thousands of professionals advancing their skills with DAXified